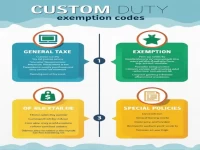

Amazon FBA Adjusts to Heavy and Dimensional Weight Challenges

This article provides a detailed analysis of the definitions of heavy goods and dimensional weight in Amazon FBA logistics, explaining the methods of freight calculation and their handling in logistics distribution. The aim is to assist sellers in optimizing cost control and shipping plans.